Accounting Regulators Cite Fair Value Measurement As Top Concern

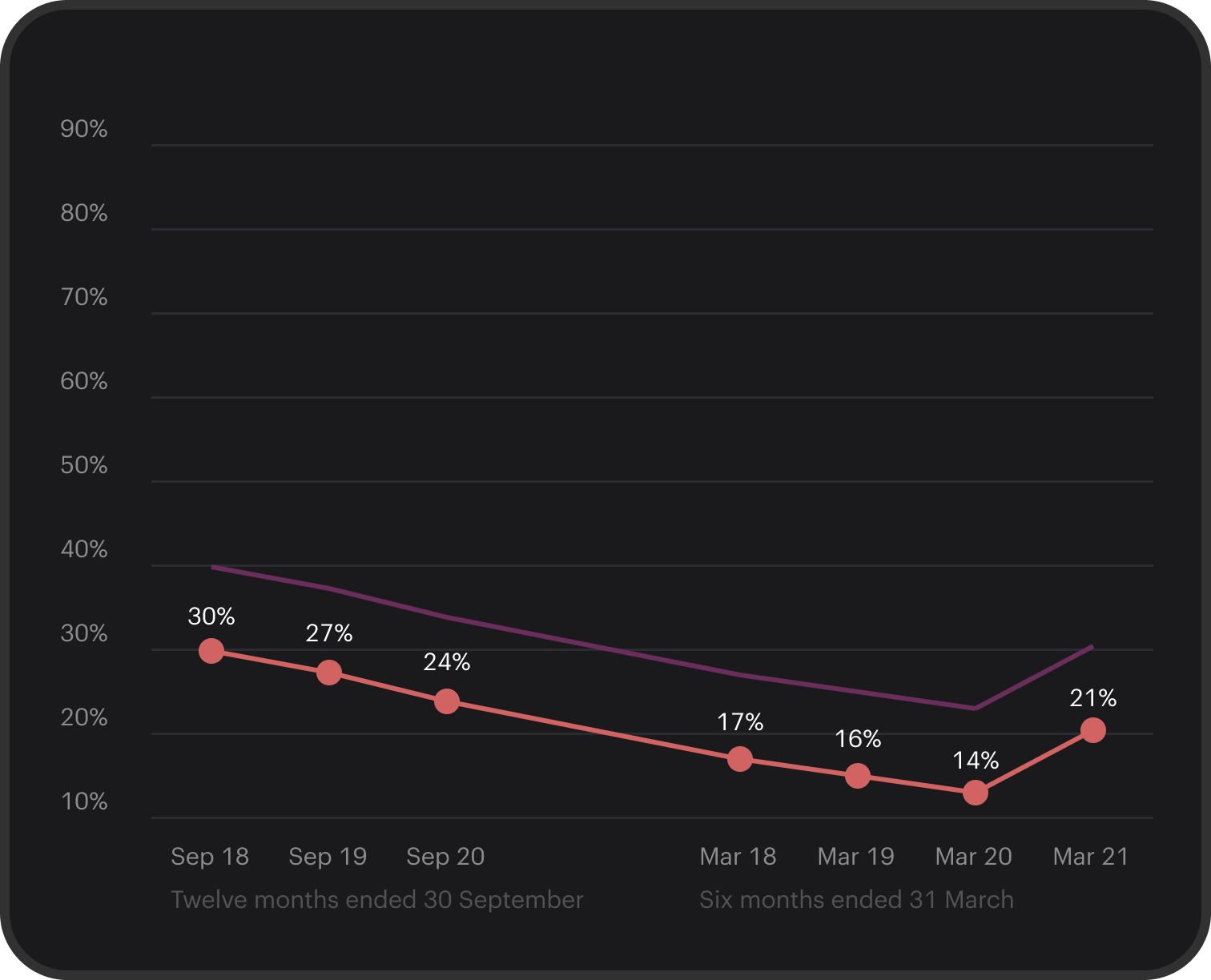

“In the last three consecutive years, accounting estimates, including fair value measurements has topped the list of common findings in Accounting and Corporate Regulatory Authority's ("ACRA") engagement inspections.

This observation is also consistent with the International Forum of Independent Audit Regulators ("IFIAR") Annual Inspection Findings Survey results, which showed that accounting estimates, including fair value measurement had the highest frequency of inspection findings for listed public interest entities’ audits in the same period.

Accounting estimates vary widely in nature and often involve extensive management’s judgements and significant assumptions, which may encompass complex models and calculation methods.

Auditing accounting estimates has never been straightforward, nor easy.

Auditors face challenges when evaluating whether significant judgments and assumptions that are susceptible to management’s manipulation or bias, whether intentional or unintentional.

The proposed amendments to the Accountants Act will also allow ACRA to require the public accountants to communicate their inspection findings and outcome, in instances of severe deficiencies (i.e. not satisfactory outcome), to their audited entities, such as audit committees of listed entities whose audits were inspected.”

paras 1.7, 1.11, 4.5, 4.6, 7.17